Value gap

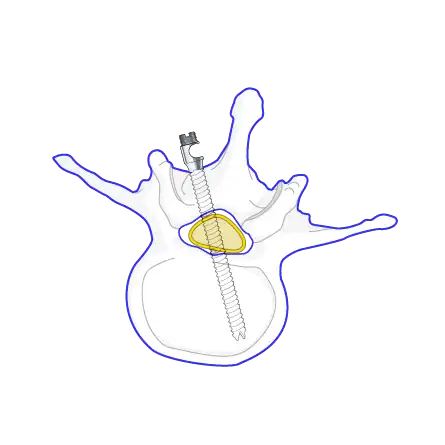

The next 2 Millimeters decide outcomes

Freehand relies on surgeon “feel”—skilled but variable. Navigation plans. Robots execute. But none sense tissue in real time. In the final millimeters of variable pedicle bone, surgeons need predictive sensing that looks ahead and confirms trajectory before breach.

Misplacement risk

revisions, neurologic complications, extended length of hopsital stay

Radiation burden

repeat shots to “check” trajectory

Lost OR time

setup, recalibration, re-imaging

Freehand variability

learning curve, reliance on tactile skill, inconsistent accuracy

The missing link:

seecure sense

A low capex, in hand sensing layer that scales to every OR, every shift, every case type.

Market size: at a glance

~3,000,000

instrumented fusions / year (global, directional)

4–6%

CAGR (devices & implants market)

1.3–2.0%

instrumented fusions / year (global, directional)

Methodology

Derived from U.S. instrumented procedure benchmarks, scaled internationally with conservative assumptions; triangulated with device-market CAGR. Figures represent directional estimates for investor decisioning, not audited counts.

From macro volume to addressable opportunity

Adoption scenarios

Derived from U.S. instrumented procedure benchmarks, scaled internationally with conservative assumptions; triangulated with device-market CAGR. Figures represent directional estimates for investor decisioning, not audited counts.

Why hospitals & surgeons switch

Adoption pathways

In hand sensing

Integrated nav/robot assist

Multi sensor predictive platform

Scale without the capex drag

Plug‑and‑Play in current workflow; complements freehand, nav, and robots

No large capital; OPEX model eases procurement

After‑hours & community hospitals: extends safety beyond tertiary centers

Bridge to integration: data outputs can inform nav/robot systems over time

Strategy canvas: positioning in the market

How seecure sense compares across key surgeon decision factors

Strategy canvas: positioning in the market

How seecure sense compares across key surgeon decision factors

AI sits at the sweet spot—high safety, low cost, scalable, and workflow-efficient.

seecure sense fills the value gap: high safety, low cost, scalable everywhere.

seecure sense AI sits at the sweet spot—high safety, low cost, scalable, and workflow-efficient. It fills the value gap left by freehand variability, DSG’s limited look-ahead, and the high-cost/rigid workflow of robots and navigation.